Asset Records

Are your assets becoming liability ???

You concentrate on your business , While we take care of your assets !!!

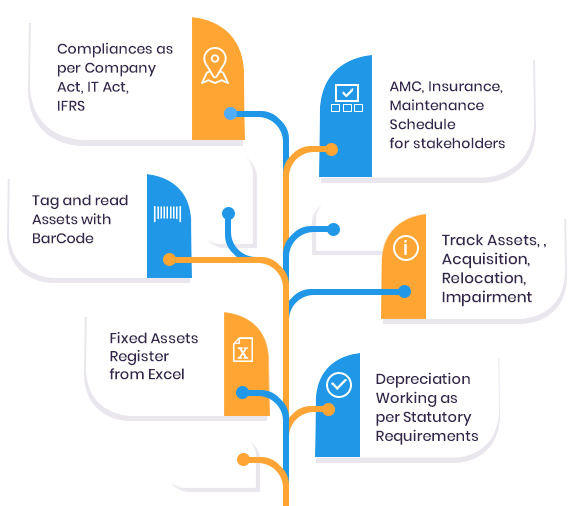

Asset Records is a Next Generation Cloud based solution to take care of your Fixed Assets Register requirement. A platform that provides a seamless experience across, Asset Records helps you keep a tab of your Assets records, Tagging and Tracking, Scheduling, Depreciation Calculation, Maintenance, AMC’s, Insurance. And all thisis available at your fingertips.

Why Asset Records???

“If you count all your Assets , You always show Profit”. -Wilson MiznerIt is an integral function of the every Organization irrespective of its size andshape, to manage its fixed assets, minimize leakages, and comply with statutory requirements and create a strong foundation for effective fixed asset management.

Fixed assets management is an accounting process that seeks to track fixed assetsfor the purposes of financial accounting, preventive maintenance, and theft deterrence. Organizations face a significant challenge to track the location, quantity, condition, maintenance and depreciation status of their fixed assets.

Features of Asset Records

Fixed Assets schedule and maintainance

Services of Asset Records

Fixed Assets schedule and maintainance

Physical Verification Of Fixed Assets

Our diligent, highly trained and skilled personnel can help your company with the fixed assets count – tagging and counting, and reconciling the results of the count with the existing fixed assets ledgers; organizing your existing records and guiding your personnel in the proper recordkeeping and maintenance of your company’s fixed assets ledgers.

With decades of experience, experts from our team are well conversant and well versed with the best practices in every industry. Many organizations have conferred their faith in us which spread across various verticals like Manufacturing, Hospitality, BFSI etc.

More

Maintaining Fixed Assets Register

Asset verification and tagging leads to identification of assets put to actual use. The rest of the assets can be reconciled and cleaned from the books of accounts. This exercise helps to keep track of the correct value of assets, which allows for computation of depreciation and taxes for insurance purposes while ensuring compliance with corporate and government policies. The use of bar-coding technology makes asset verification simple and efficient. The exercise also helps to clean up the asset register of any disposals or movements that may not have been captured in the books and by giving up to date records of the asset.

Audit Of Fixed Assets

Asset Records can be counted on to assist you in the preparation, reconciliation and maintenance of your fixed assets ledgers . We help you in managing, creating and maintaining your Fixed Assets. We provide with the analytics to help your organization with the necessary data visibility to avoid the risk of non-compliance with financial, tax and regulatory issues.

We also provide a keeping a record of your assets like Land and Buildings, Roads, Infrastructure , bulk assets, ghost assets, intangibles, etc.

Our team ensures the accomplishment of FAR related tasks within timelines and deliver our services with superior quality, in a defined timeline and with minimal disruption to your operations.

Depreciation Calculation

You can perform depreciations for any period. The depreciation calculations can easily run by creating depreciation suggestions and by automatically correcting depreciation that is too high or low. You can use planned and unplanned depreciation amounts if an amount varies from the calculated depreciation amount that is entered.

Depreciation model for each set of books.

Definition of depreciation methods

Depreciation to the day

More